The Benefits of Forex Trading: Unlocking Financial Opportunities

Forex trading has gained immense popularity among individual and institutional investors alike, primarily due to its unique benefits compared to other forms of trading. One of the significant advantages of Forex trading is the 24-hour accessibility, allowing traders to participate in the market at any time. For those interested in starting their trading journey, the benefit of forex trading Trading Platform MA offers an excellent starting point.

1. 24/5 Market Availability

The Forex market operates 24 hours a day from Monday to Friday, enabling traders across different time zones to engage in trading. This accessibility allows traders to react to market news and events promptly, regardless of their schedules. Unlike traditional stock markets that have set hours, Forex trading offers unparalleled flexibility, catering to both part-time and full-time traders.

2. High Liquidity

Forex is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. This high liquidity ensures that traders can enter and exit positions quickly without causing significant price fluctuations. High liquidity also means that tight spreads (the difference between buying and selling prices) are often available, reducing trading costs and improving profitability.

3. Leverage Opportunities

One of the notable features of Forex trading is the ability to use leverage. Leverage allows traders to control larger positions with a relatively small amount of capital. For instance, with a leverage ratio of 100:1, a trader can control a position worth $10,000 with just $100 in their trading account. Although leverage can magnify profits, it also increases risk, so it’s essential for traders to use it judiciously and implement effective risk management strategies.

4. Diverse Trading Options

The Forex market offers a wide variety of trading pairs, including major, minor, and exotic currency pairs. This diversity allows traders to explore various market conditions, gaining exposure to different economies and geopolitical factors. Traders can capitalize on fluctuations in currency values due to economic indicators, interest rate changes, and political events, making Forex trading a versatile investment opportunity.

5. Low Barriers to Entry

Starting in Forex trading has relatively low barriers compared to other financial markets. Many Forex brokers offer accounts with minimal initial deposits, enabling individuals to start trading with limited funds. Additionally, the availability of demo accounts allows new traders to practice their skills and develop strategies without risking any real capital.

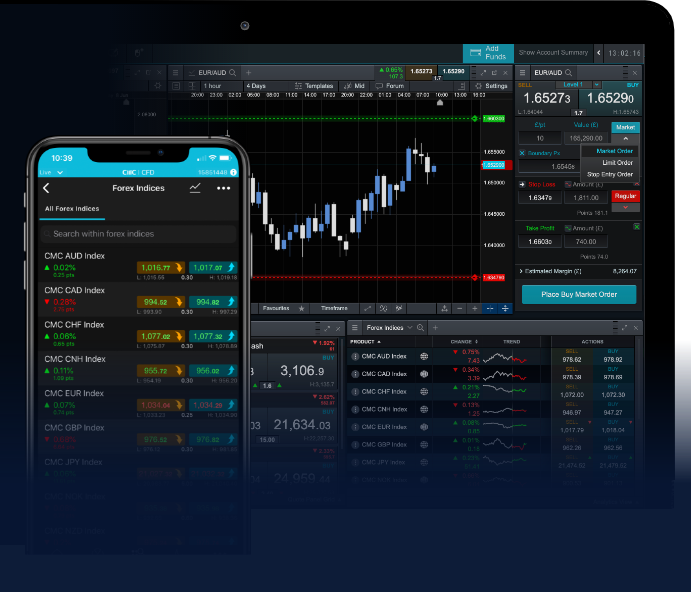

6. Advanced Trading Tools and Technology

Forex trading platforms are equipped with advanced tools and technologies that enhance trading experiences. From charting software and technical analysis tools to automated trading systems, traders can leverage technology to execute trades effectively. Many brokers also offer research and educational resources to help traders refine their skills and stay informed about market developments.

7. Potential for Profit in Rising and Falling Markets

Unlike traditional stock trading, where investors can only gain profits when prices rise, Forex trading allows for potential gains in both rising and falling markets. Traders can go long (buy) when they anticipate a currency will appreciate and go short (sell) when they believe a currency will depreciate. This flexibility allows traders to adapt strategies based on market conditions and increases profit opportunities.

8. Hedging Opportunities

Forex trading provides a valuable avenue for hedging against currency risk. Businesses engaged in international trade can use Forex transactions to protect themselves from unfavorable currency fluctuations. Similarly, investors can hedge their portfolios against potential losses by taking opposite positions in Forex. This risk management strategy can be instrumental in safeguarding investments during volatile market conditions.

9. Growing Popularity of Cryptocurrency Trading

The intersection of Forex and cryptocurrency trading has gained traction in recent years. Many Forex brokers now offer the ability to trade cryptocurrencies alongside traditional currency pairs. This convergence provides an exciting opportunity for traders looking to diversify their portfolios and capitalize on the rapid growth of digital currencies while benefiting from the established Forex infrastructure.

10. Community and Support

Forex trading is bolstered by a strong community of traders and numerous platforms where knowledge sharing is encouraged. Online forums, social media groups, and trading workshops present opportunities to learn, exchange information, and stay motivated. Engaging with other traders can help newcomers gain insights and refine their strategies, enhancing their trading journey.

Conclusion

The benefits of Forex trading are manifold, making it an attractive option for both seasoned and novice traders. Its 24-hour availability, high liquidity, and leverage options provide unique opportunities to maximize returns. However, it’s crucial for traders to approach Forex trading with a clear strategy and a thorough understanding of the risks involved.

As the Forex market continues to evolve, those who stay informed and engaged can unlock countless financial opportunities. Whether you are conducting independent research or utilizing resources from platforms like Trading Platform MA, taking steps toward informed trading can lead to a successful Forex experience. Explore the potential of Forex trading today and discover the vast opportunities that await.